What Does Paul B Insurance Medicare Health Advantage Melville Mean?

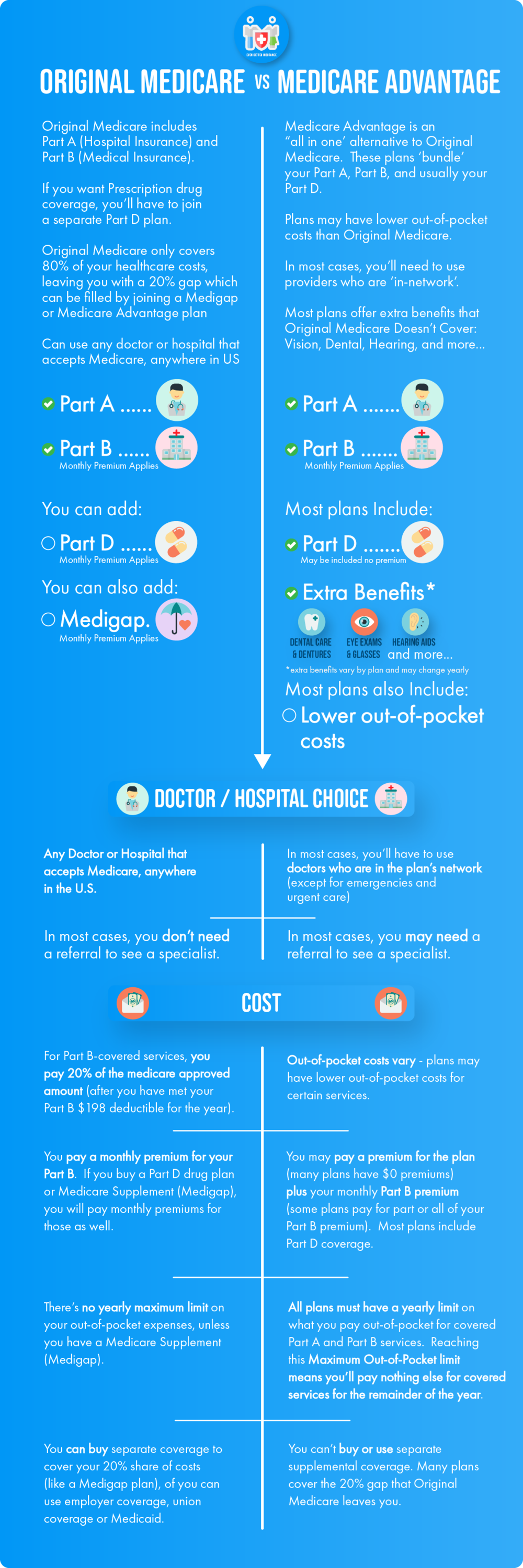

enroll to see what benefits it supplies, if you could qualify, as well as if there are any kind of restrictions. Find out more regarding what Medicare Advantage Program cover. Medicare pays a set amount for your care monthly to the firms offering Medicare Advantage Plans. Each Medicare Advantage Plan can bill various out-of-pocket expenses. They can likewise have various guidelines for just how you get services, like: Whether you require a recommendation to see a professional If you need to go to physicians, centers, or providers that belong to the plan for non-emergency or non-urgent care These policies can transform annually. You'll require to make use of wellness treatment service providers that get involved in the strategy's network. Some strategies will not cover services from providers outside the plan's network as well as solution area - paul b insurance medicare health advantage melville. Medicare Advantage Strategies have a on your out-of-pocket prices for all Component An and Part B services. When you reach this limitation, you'll

pay nothing for services Component An and also Part B cover. You can sign up with a different Medicare medication strategy with certain types of strategies that: Can not use drug protection (like Medicare Medical Savings Account plans )Choose not to use medicine coverage(like some Private Fee-for-Service plans)You'll be disenrolled from your Medicare Benefit Plan as well as went back to Original Medicare if both of these apply: You remain in a Medicare Advantage HMO or PPO. If you join an HMO or PPO that does not cover medicines, you can't sign up with a different Medicare drug strategy. In this case, either you'll require to utilize other prescription medicine insurance coverage you have(like company or retired person coverage ), or do without medicine protection. If you make a decision not to obtain Medicare medicine insurance coverage when you're very first eligible and also your various other medication protection isn't creditable prescription medicine protection, you may have to pay a late registration charge if you sign up with a plan later on. You can not use Medigap to spend for any kind of prices( copayments, deductibles, and costs )you have under a Medicare Benefit Strategy. Find out about your options connected to Medigap policies and also Medicare Advantage Program. The fundamental info in this brochure gives a summary of the Medicare program. More thorough info on Medicare's advantages, expenses, as well as wellness service choices is offered from the Centers for Medicare & Medicaid Provider (CMS) magazine which is sent by mail to Medicare beneficiary families each fall as well as to brand-new Medicare beneficiaries when they come to be eligible for insurance coverage. It provides basic defense versus the cost of healthcare, however it does not

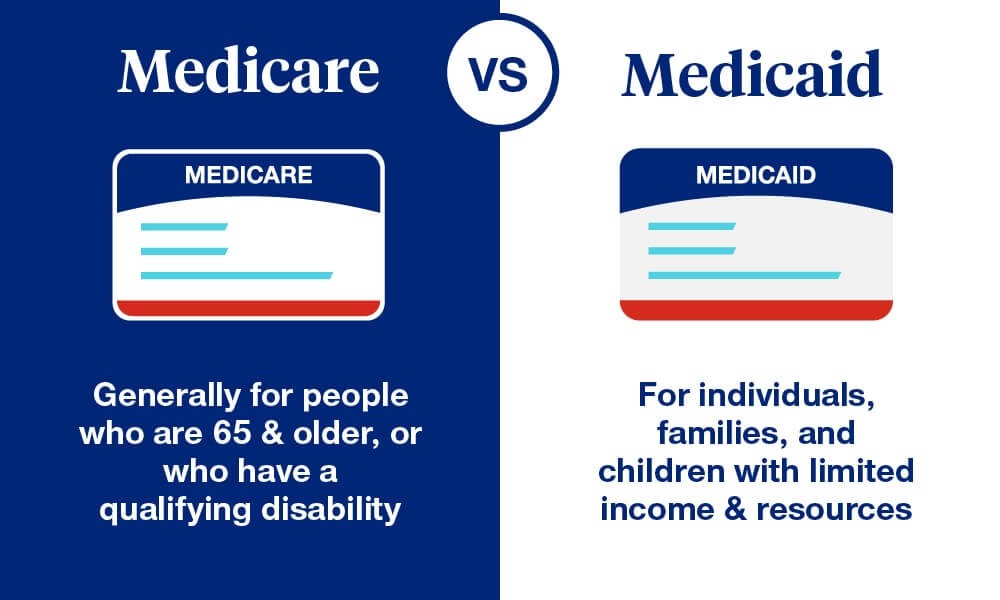

Prior to age 65, you are eligible for totally free Medicare healthcare facility insurance if you have actually been entitled to regular monthly benefits based on a complete handicap for at least 24 months as well as have a handicap guaranteed condition under social safety legislation. You are also qualified for Medicare if you have

Lou Gehrig's disease(amyotrophic lateral side). Any individual eligible for totally free Medicare medical facility insurance can enroll in Medicare medical insurance(Component B)by paying a monthly costs.

Indicators on Paul B Insurance Medicare Advantage Agent Melville You Need To Know

(Although the age requirements for some unreduced railway retired life advantages have actually increased simply like the social safety demands, beneficiaries are still qualified for Medicare at age 65.)Before age 65, you are qualified absolutely free Medicare hospital insurance if you have actually been entitled to month-to-month advantages based on an overall impairment for a minimum of 24 months and also have a handicap guaranteed status under social security legislation. If you receive advantages as a result of work-related disability and have actually not been approved an impairment freeze, you are normally qualified for Medicare health center insurance coverage at age 65.(The standards for a handicap freeze resolution comply with social protection law as well as are similar to the clinical criteria for giving overall disability.)You are also eligible for Medicare if you have

Lou Gehrig's illness(amyotrophic lateral sclerosis). Handicapped widowers under age 65, handicapped enduring separated partners under age 65, and handicapped children may be qualified for Medicare, usually after a 24-month waiting period. If you have long-term kidney failure, you are over at this website eligible totally free Medicare hospital insurance policy at any type of age. This holds true if you get upkeep dialysis or a kidney transplant and also you are eligible for or are getting month-to-month advantages under the railroad retired life or social safety and security system. Any individual eligible absolutely free Medicare medical facility insurance can enroll in Medicare medical insurance(Component B)by paying a month-to-month costs. The standard premium rate for new enrollees is$164. 90 in 2023. This is about$ 5 less than the 2022 costs amount. Regular monthly costs for some beneficiaries are higher, relying on their customized adjusted gross earnings.

Lou Gehrig's disease(amyotrophic side sclerosis). Handicapped widowers under age 65, handicapped surviving divorced partners under age 65, and impaired medicare prescription kids may be eligible for Medicare, usually after a 24-month waiting duration. If you have permanent kidney failing, you are qualified free of charge Medicare healthcare facility insurance coverage at any age. This is true if you obtain upkeep dialysis or a kidney transplant as well as you are eligible for or are receiving month-to-month benefits under the railway retirement or social safety system. Any person eligible absolutely free Medicare medical facility insurance can sign up in Medicare clinical insurance coverage(Part B)by paying a regular monthly costs. The standard premium price for new enrollees is$164. 90 in 2023. This is about$ 5 less than the 2022 premium amount. Month-to-month costs for some recipients are greater, depending upon their customized adjusted gross income.

Prior to age 65, you are eligible for cost-free Medicare health center insurance if you have been qualified to month-to-month benefits based on a total handicap for at least 24 months and have a special needs guaranteed condition under social safety and security law. You are also eligible for Medicare if you have

Lou Gehrig's diseaseIllnessamyotrophic lateral side). Any person eligible for complimentary Medicare health center insurance can register in Medicare clinical insurance(Component B)by paying a month-to-month premium.

Before age 65, you are eligible for totally free Medicare health center insurance policy if you have actually been qualified to month-to-month advantages based on a complete disability for at least 24 months and have a special needs guaranteed standing under social safety and security legislation. You are likewise qualified for Medicare if you have

Lou Gehrig's diseaseIllnessamyotrophic lateral side). Anyone eligible for totally free Medicare medical facility insurance can enroll in Medicare medical insurance(Component B)by paying a regular monthly costs.

:max_bytes(150000):strip_icc()/GettyImages-1339459004-66cde56b1ebd4192b43c63995edfa7be.jpg)